The semiconductor industry demands precision, innovation, and relentless efficiency. As chip manufacturing evolves, the materials…

Should I Invest In Art? – 5 Things You Should Know

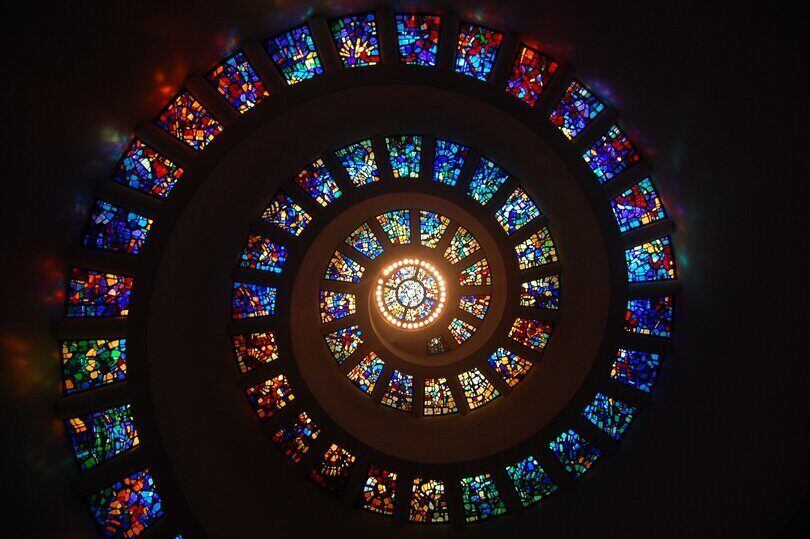

Art is an interesting and engaging addition for diversifying any investment portfolio. However, investing in art has its own unique set of risks that should be considered before investing. To help you make informed decisions about your investments, here are five things to consider when deciding whether or not to invest in art.

Different Types Of Art Investments You Can Make

Before we talk about investing in art, it’s important to understand what constitutes art. Art is broadly defined as any visual or tangible expression, including painting, sculpture, photography, and more. When it comes to investing in art, there are a few different options you can choose from.

- Physical Art: This entails purchasing a piece of art, such as a painting or sculpture, and storing it somewhere safe until you can sell it later. It is common to see art appreciate in value over time in the art market. May art investors buy art for its aesthetic appeal, as well as for potential financial gain.

- Art Funds: Art funds are investment funds that allow investors to buy into a collection of artworks. Professionals typically manage these funds, and the value of the fund’s portfolio will depend on the appreciation of the pieces in it.

- Collectible Coins and Artifacts: This type of investment involves buying coins or artifacts with the potential for appreciation in value over time. Investing in coins and artifacts can be risky due to their lack of liquidity, so it is important to research before investing. In auction houses, it is common to see coins and artifacts appreciate value.

- Art-Backed Securities: This kind of investment allows investors to invest in art by purchasing bonds backed by a portfolio of art pieces. This investment offers lower risk than physical artwork and is more suitable for beginner investors.

Art Evaluation – How Is Art Evaluated?

When evaluating art, various factors come into play, such as the artist’s reputation, the condition of the piece, and its historical significance. Art experts use specialized tools and techniques to assess the value of a work of art.

One tool used by experts is comparative market analysis (CMA). This involves the examination of art pieces that have recently been traded, either at auctions or private sales. This helps determine the estimated value of a piece by comparing it to similar works.

In addition to CMA, experts also consider factors such as an artist’s reputation and the condition of their artwork. An artist who is well-known in their field can command higher prices for their work than lesser-known artists. Also, artwork that is in good condition will usually fetch a higher price than that which is not.

Experts also look at how often a particular piece has been shown or exhibited publicly since this can affect its value. Historical significance is another factor when evaluating art – pieces with ties to important figures or events will be more highly sought.

Finally, experts consider the current state of the art market and economic trends when assessing a piece’s value. By evaluating these factors, they can accurately understand how much a particular artwork is worth. This helps to ensure that investors receive fair prices for their investments.

Why Are Companies And Individuals Investing In Art?

There are several benefits associated with investing in art. Art can be an attractive asset, from diversifying investment portfolios to creating a meaningful connection.

Diversification

Art can provide a level of diversification to an investment portfolio that other assets cannot. Individuals and companies can protect their portfolios from market volatility by investing in art. Additionally, art investments may experience less volatility than other asset classes due to their low correlation with the stock and bond markets. This can be especially beneficial for investors looking to diversify into non-traditional assets. Also, art investment can also provide greater returns than traditional investments over an extended period.

Appreciation Potential

Art has the potential to appreciate over time due to its rarity, quality, and historical pedigree. Investment-grade art is often identified by experts who can provide a detailed analysis of a piece’s potential value. This appreciation potential makes investing in art attractive to those looking for long-term gains and short-term profits. The proceeds are often tax-free capital gains when a fine art piece is sold.

Intangible Benefits

In art, a piece’s value can be based on its aesthetic appeal and emotional connection. The intangible benefits should not be overlooked for individuals or companies investing in art. Collecting artwork is more than just an investment; it can bring the collector joy, satisfaction, and prestige. Art may also be used as part of a corporate identity, which can help create a positive public image and build customer relationships.

Liquidity

Art can be an attractive option for investors looking for a liquid asset. With the right contacts and research, art can often be bought and sold quickly. Art has also become easier to buy and sell due to the proliferation of online marketplaces such as Artsy and Sotheby’s BIDTALK. Art can provide a way to do so for investors that need to access their funds quickly. As art fairs and online marketplaces become more sophisticated, the liquidity of art investments can only improve.

How To Start Building Your Art Portfolio

Building an art portfolio can be a rewarding experience. It is important to research the market thoroughly before investing in any artwork, as prices for pieces can vary significantly.

Set a budget and goals

Before investing in art, it’s important to understand your financial situation clearly. Set aside a certain amount of funds to purchase artwork, and determine what type of return you expect from this investment. Suppose you’re looking for a long-term investment. You may want to focus on art pieces with strong appreciation potential. If you are looking for a mid-term return, you may instead be interested in purchasing existing works that have already been established as valuable.

Research the Market

Research is key when it comes to investing in art. Familiarize yourself with the markets and artists you’re interested in and the various online and offline dealers. Read up on trends in the industry, and attend some auctions or exhibitions to get a feel for how art is valued. Knowing what types of artwork are in demand will help inform your purchase decisions.

Know the Risks

As with any other investment vehicle, there are risks associated with investing in art. Prices can fluctuate widely, and pieces may not appreciate as expected. It is important to be aware of potential pitfalls before entering the market so that you can make informed decisions about where to allocate your funds. Doing proper research ahead of time will help mitigate this risk. The contemporary art market can be unpredictable, so it’s important to understand the risks involved before investing.

Vet Your Sources

When purchasing artwork, it is essential to use reliable and trustworthy sources. Do proper research on potential dealers and galleries, ensuring they are reputable and have a good track record of delivering high-quality art. It is also wise to consult with art professionals, as they can provide valuable insight into the market.

Diversify Your Investment

Finally, it’s important to diversify your portfolio when investing in art. Don’t put all of your eggs in one basket – instead, spread your investments across various styles, periods, and artists. This will help reduce risk and ensure you don’t lose all of your money should one particular artist or artwork not appreciate.

5 Things You Should Know Before Investing In Art

The following five tips can help build a successful and rewarding art portfolio.

Art Is a Long-Term Investment

It can take years to realize the full potential of art investment. As with any financial decision, it’s important to research and assess the risks before taking a plunge into art investments. Consider whether there is enough tangible evidence that points towards future success for your chosen artwork or artist, such as exhibition history and awards won. Investing in art requires patience, but it can be highly profitable with the right research and long-term outlook.

Understand Market Cycles

The art market is cyclical, and demand for certain artists or types of artwork can fluctuate over time. When looking to invest, it’s important to identify the kind of artwork or artist currently in vogue and likely to hold its value, as well as those that appear overvalued.

In the auction house, it’s essential to bid on the right artwork at the right time. When a fine art piece is priced too low in the global art market, the bidder should not be worried about a bidding war. Consulting an art market report can help you understand the right time to purchase.

Art is Risky

Art is often seen as a relatively safe investment due to its limited physical exposure and lack of liquidity. However, it still has its risks and can be volatile. Any investment has the potential to succeed or fail. When the fair market value of a piece is not established, buyers may overpay for art.

The Art Market Follows Rules of Its Own

Unlike financial markets, the art market does not follow predictable rules. Art is a subjective and complex investment, so it’s important to recognize that it may not behave like other investments. It is also worth noting that artwork can often be subject to long-term appreciation or depreciation without any underlying fundamentals driving its performance.

Don’t Think That Just Because You Sell Your Artwork Means It Will Have Value Later On

The value of an artwork is determined by several factors, such as its condition, provenance, exhibition history, etc. Therefore it’s important to remember that the market price of the work when you buy it may not reflect its future market value. When investing in art, it’s important to focus on those works which are likely to increase in value over time.

How To Care For Your Artwork Investments

Once you’ve invested in art, it’s important to consider how to best protect your artwork from damage.

Aluminized Cover For The Protection Of Works Of Art And Valuables

OTEGO offers a wide range of products for protecting assets. For artwork, we have the OTEGO Fireguard, which is an aluminized cover to protect artwork from extreme temperatures or weather elements. Here are its features to prove why we highly recommend it.

- Complies with REACH European Regulation n° 1907/2006

It has been tested and certified to be free of substances harmful to the environment and human health. When art collectors or owners of valuable items buy a product for protection, they can be sure that it complies with all safety regulations.

- Storage – compact and space-saving c

The Fireguard is lightweight, foldable, and can be easily stored. This makes it convenient to keep and unfold whenever an extra layer of protection is needed for transport and storage of artwork. Suppose you bought a painting but don’t want to display it yet – you can use the Fireguard as extra protection against fire or other hazards.

- Lightweight

Our aluminized cover is very lightweight and easy to handle, making it perfect to use as another layer of protection when transporting artwork from one place to another. The fact that it’s very light means it won’t add a significant weight during transport.

- Sturdy and reliable

Last but not least, the Fireguard is also a great option for protecting your artwork from dust and dirt. The fabric won’t scratch your artwork’s surface, meaning it will stay as good as new for longer.

The OTEGO Fireguard is definitely the right choice if you are looking for a reliable and safe way to add an extra layer of protection on your artwork investments. It offers superior protection against extreme temperatures, dust, and dirt while complying with European safety regulations and being environment-friendly.

Contact us if you want to know more about this product.